32. Week 9 Wraps Up Hot

DISCLAIMER: This is a simulated educational exercise using paper trading fake money. This is not investment advice and is not intended to be copied.

TLDR

- Trades Wednesday 31 May

- SOLD 1 CRWD 2 JUNE 23 144 PUT @2.90

- SOLD 1 CRM 2 JUNE 23 200 PUT @2.99

- Trades Thursday 1 June

- BOUGHT (To Close) 1 OKTA 2 JUNE 23 76 PUT @0.94 (Profit of 1.11)

- BOUGHT (To Close) 1 CRWD 2 JUNE 23 144 PUT @2.14 (Profit of 0.76)

- BOUGHT (To Close) 1 ABNB 2 JUNE 23 97 PUT @0.03 (Profit of 0.8)

- BOUGHT (To Close) 1 CRM 2 JUNE 23 200 PUT @0.08 (Profit of 2.91)

- SOLD 1 LULU 2 JUNE 23 297.5 PUT @2.94

- Trades Friday 2 June

- EXPIRED 1 LULU 2 JUNE 23 297.5 PUT

- Sitting on cash heading into next week

Today In Review

Three wild days packed together in this post! I’m going to keep this one shorter today and just summarize the key actions.

Wednesday 31 May

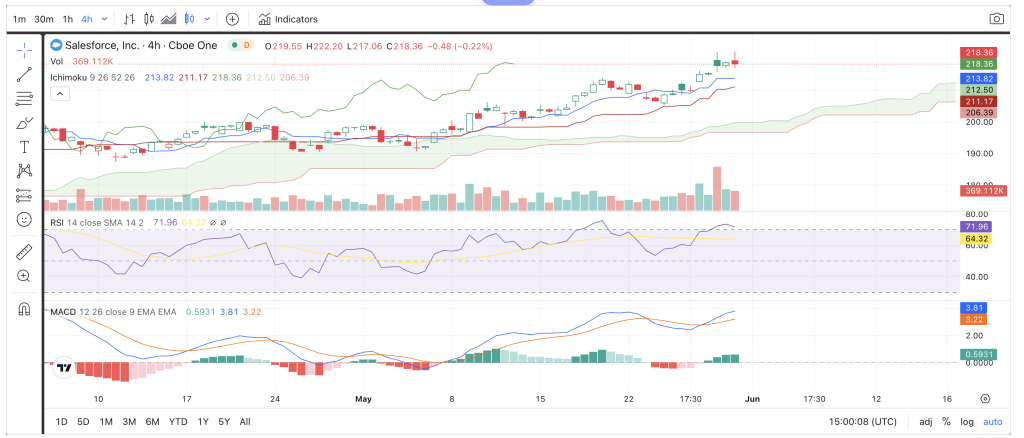

Wednesday the AI flagged both CRM and CRWD on the put side. Both were heading into earnings and the market had priced in plenty of risk premium with only a couple days of holding. Both CRM and CRWD shared my new favorite pattern for trading – essentially showing bullish momentum based technicals but bearish pricing based technicals

The premiums were large, so I took one on each that were far out of the money to give myself some breathing room. While CRWD was trading at 158 I wrote a put at 144. While CRM was trading at 218 I wrote a put for 200.

Thursday

Thursday was active. OKTA, CRWD, and CRM all shot down after earnings Wednesday evening. I knew I had to act fast so I was ready in the morning at opening bell.

First thing I did was get the hell out of OKTA, which was priced close to $2 ITM. I bought the put back at a 0.94 premium somehow, which still left my positive on the trade overall.

Next came CRWD. I was still out of the money but just barely. Premiums dropped as well since a lot of the volatility had shaken out. I didn’t want to risk it so I bought it back at $2.14 premium to get a profit of $0.76 for a few hours hold.

Now for CRM. It also dropped but recovered and wasn’t threatening the $200 price at all. So I didn’t act on it and kept my standing limit order to buy back at $0.08 to free up the capital. That was executed later in the day, leaving me a lovely profit for a 1 day hold.

In a similar way my open ABNB put from earlier in the week hit its limit order. I bought that back for $0.03 premium, giving me a small profit of $0.8 on the trade. Hardly worth anything, but this was my early week “I’m bored” trade so whatever.

That wasn’t enough for the day, so I looked at the AI and saw our good friend LULU. Last earnings cycle LULU crushed it and the stock went way up. The AI was indicating that could happen again. I had a hard time believing lightning would strike twice, but in the closing minutes of the day I decided to get a little skin in the game. While trading around $329 I wrote a put at $297.50 for a generous $2.94 premium.

Friday

LULU crushed it and immediately shot up $30. So I let my open position expire and kept the full premium on a one day hold.

The AI flagged a few other interesting stocks but premiums weren’t all that high. Considering my productive week I decided not to push anything and call it a win heading into the weekend.

Portfolio Standings

| Portfolio Value (Open) (W) | $ 105,860.50 |

| Portfolio Value (Close) (F) | $ 107,199.00 |

| Change (W-F) | 1.26% |

| Change (Tot) | 7.20% |

| Free Cash (Close) | $ 89,013.00 |

| Escrowed Cash (Close) | $ 0 |

| Equities (Close) | $ 18,186.00 |

| Trades Made (W-F) | 8 |

Closing Thoughts

I start out the week next week with no open option positions and great momentum, looking forward to finding more deals.

After 9 weeks I’m up 7.2% vs a goal of 4.5%. I’m sure that will come back in when ENPH drops, but will definitely slow back on risk in the meantime while I can!