23. Week 6 – Ready, Set, Go

DISCLAIMER: This is a simulated educational exercise using paper trading fake money. This is not investment advice and is not intended to be copied.

TLDR

- Trades today

- SOLD -1 HUBS 100 12 MAY 23 430 PUT @5.30

- BOUGHT +1 HUBS 100 12 MAY 23 430 PUT @3.30

- SOLD -1 ABNB 100 12 MAY 23 115 PUT @1.33

- A quick $200 from HUBS netted, doubled down on ABNB

Today In Review

What an active start to the week! Nothing like netting an unexpected $200 in ~2 hours to boost you out of the Monday blues.

HUBS

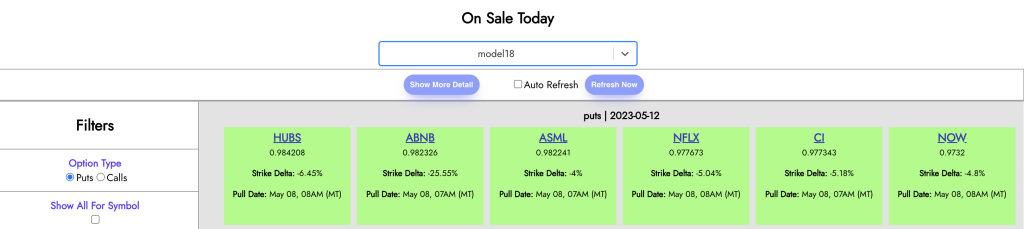

First thing I checked today was my favorite model, model18. And immediately I noticed it flagging a trade with HUBS:

I had a good run with HUBS in one of the previous weeks and noticed a high AI score, so I clicked in. Checking out the technicals I saw a bit of a mixed story:

The Ichimoku Cloud and MACD were showing bullish signs, but the RSI was bearish. Given how expensive this stock is I normally would stay away. However time was running out on my coffee break. I pulled open the option chain and noticed it was trading at $437 but premiums were super high for $430. I thought I would trust the AI and write a put and check back in later, netting a $5.30 premium.

Flash forward to a couple hours later. Eager to make another trade I checked in on my HUBS position and noticed it was already down to a sub $4 premium. I decided to throw out a limit order while I checked other stocks, and much to my surprise it was quickly executed. So I bought the contract back at $3.30, netting me an easy $200 with only a couple hours of a hold.

ABNB

Next I analyzed the most popular stocks today across all the models. Every single one was writing the most puts for ABNB. Now, I already have an open ABNB contract from last week which expires Friday so I was hesitant to write another. But I felt very good about the win earlier in the day and decided to trust in the AI.

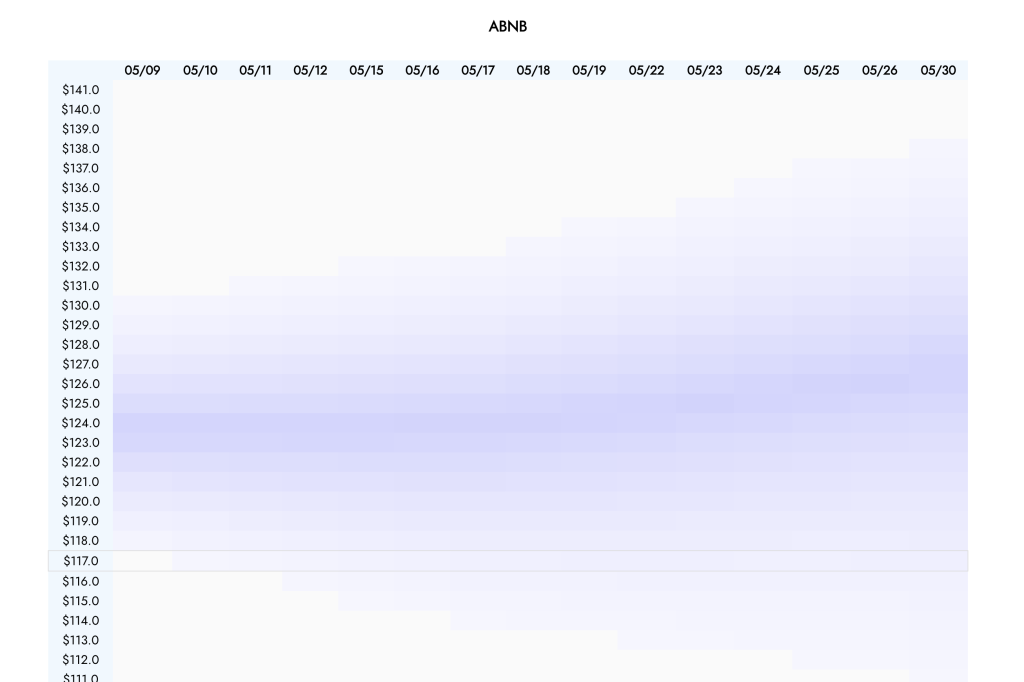

The AI centerline is projecting a slight increase in price over the next few days (with risk to the downside prevalent as well):

For this reason I did decide to write one today, with the hope that it moves up Tuesday or Wednesday and I can buy it back quickly. I wrote a put at a $115 strike for only a $1.33 premium. I would normally like more premium for double exposure like this, but I couldn’t find much else to trade and had an itch to scratch.

Portfolio Standings (WIP formatting)

| Portfolio Value (Open) | $ 98,201.00 |

| Portfolio Value (Close) | $ 99,898.00 |

| Change (Day) | 0.70% |

| Change (Tot) | ( 0.1 % ) |

| Free Cash (Close) | $ 39,369.00 |

| Escrowed Cash (Close) | $ 44,200.00 |

| Equities (Close) | $ 16,329.00 |

| Trades Made Today | 3 |

Closing Thoughts

I don’t like having two open ABNB contracts, so I will likely look to close at least one of them with 50% profit given the opportunity. I still have a decent amount of capital available to me for more trades later in the week, looking forward to active trading.