37. Week 14 – Premiums Still On Summer Vacation?

DISCLAIMER: This is a simulated educational exercise using paper trading fake money. This is not investment advice and is not intended to be copied.

TLDR

- Trades Monday 3 July

- None

- Trades Tuesday 4 July

- None (Market closed; holiday)

- Trades Wednesday 5 July

- None

- Trades Thursday 6 July

- None

- Trades Friday 7 July

- SOLD 1 TSLA 14 JULY 23 260 PUT @1.70

- Waiting for summer vacation to end…

Week In Review

Up until 3:45pm ET on Friday, it was yet another week of nothing worth trading. I did wind up making one trade in the final minutes of the day. But I figured with the lack of activity the last few weeks I would provide at least a little more color what’s been going on.

Why haven’t I been trading?

To give a bit more insight, one of my most basic levels of screening is whether or not the premium is nominally high enough to be worth my time. Even if there’s a 99% chance of success, if it’s only a $0.20 premium I’d just rather not bother. So far that’s basically been the case for anything more than 2% out of the money.

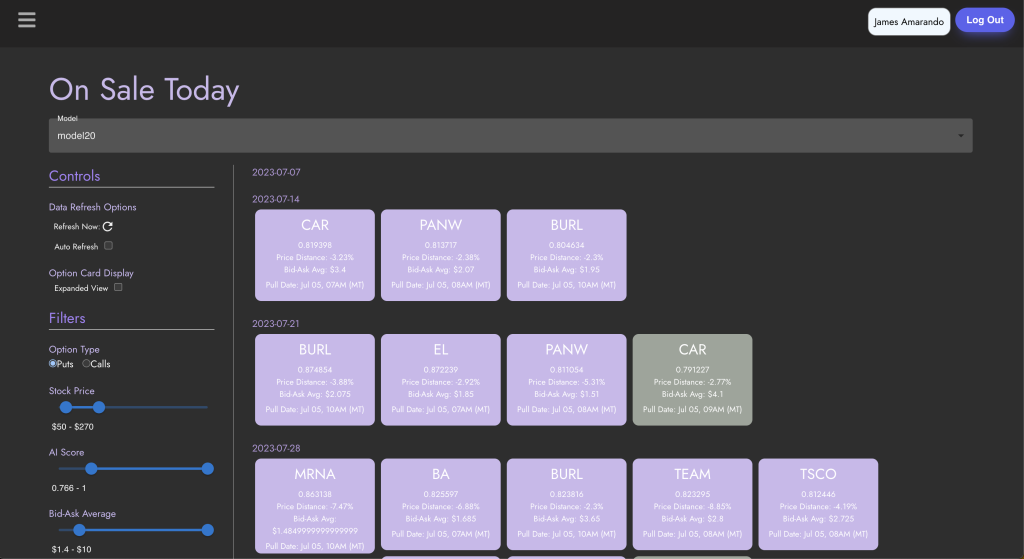

So what I do throughout the day is monitor the front end to the AI that I built for anything that remotely matches this basic criteria. For the last few weeks out of all the stocks and options out there, this is essentially all I see:

In more detail, looking only a week or two out I see as many options as I can count on my fingers. That’s only the very first filter. What typically happens (as with those pictured here) is my secondary levels of screening will knock them out quickly. These include things like:

- Strike is too close to the stock price for my comfort

- Stock is too expensive in general (i.e. I don’t want to risk 50% of my portfolio on one trade)

- Underlying technicals or fundamentals are very worrisome

- AI score isn’t strong enough to override the above concerns

The closing minutes of Friday

I had already given up on the week but as I went to close my laptop Friday with literally minutes remaining in the trading week I noticed the AI flagging TSLA with premiums that were > $1 (oh how the times have changed…). I’ve been so bored the last few weeks with no activity that I rushed in.

The AI lined up quite a few, in particular I landed on a trade at a $260 strike which the AI gave a 0.94 / 1 score to. Now, in previous weeks I had said I wanted to avoid TSLA, NVDA, and others as I felt they are very overvalued. However I’m just too antsy at this point and decided to take the risk. So while trading at $274 I wrote the put at $260 for a measly $1.70 premium, but hey at least it’s something.

Portfolio Standings

| Portfolio Value (Open) (M) | $ 107,846.00 |

| Portfolio Value (Close) (F) | $ 107,332.00 |

| Change (M-F) | ( 0.48 ) % |

| Change (Tot) | 7.33 % |

| Free Cash (Close) | $ 64,715.00 |

| Escrowed Cash (Close) | $ 26,000.00 |

| Equities (Close) | $ 16,617.00 |

| Trades Made (M-F) | 1 |

Closing Thought

I have been lax trading ENPH calls due to the low premiums, but I should really do that already to get it off my books. My losses the last 2 weeks of ~2% overall have been due to ENPH dropping in value. It’s currently around $166, I’d like to exit at $180 (even though I’m net positive still below that).

Hopefully after this weird holiday week traders are back with earnings kicking off next week – and with them the volatility.