30. Week 8 Wrap Up

DISCLAIMER: This is a simulated educational exercise using paper trading fake money. This is not investment advice and is not intended to be copied.

TLDR

- Trades Thursday 25 May

- None

- Trades Friday 26 May

- BOUGHT (To Close) 1 WDAY 26 MAY 23 180 PUT @0.08 (Profit of 1.08)

- SOLD 1 CRWD 2 JUNE 23 140 PUT @2.9

- BOUGHT (To Close) 1 CRWD 2 JUNE 23 140 PUT @2.08 (Profit of 0.82)

- Took advantage of an easy ~3 hour hold of CRWD for a decent premium

Today In Review

Thursday 25 May was a busy day for me, the market looked complicated, and therefore I didn’t trade.

Friday 26 May I had a little bit more time. First thing, not long after the market opened my limit order to buy back my WDAY option was executed. WDAY had risen significantly overnight. If I was more on top of things I would have let it expire, but it’s only an $0.08 premium wasted so no big deal.

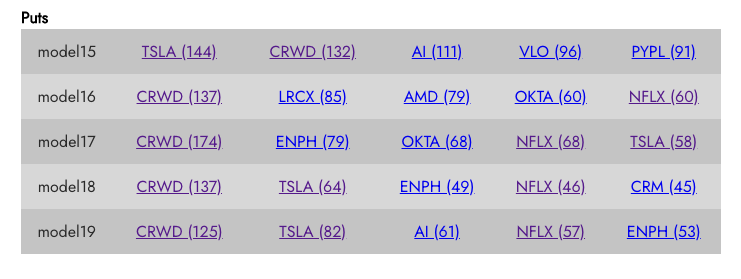

Turning to the AI, CRWD was lighting up green by all models:

Investigating the technicals I saw a familiar story:

The RSI was overbought but the MACD and Ichimoku cloud were bullish. It seems this AI is fairly good at finding these types of stocks. Feeling more and more confident I decided to dive in. While trading at $153 I wrote a put for $140 netting a $2.90 premium.

Three or so hours later I came back to the brokerage and noticed it was already trading decently lower than before. I had a chance to buy it back for almost a dollar less. Not wanting any stress over the holiday weekend I decided to go for it. So while trading at $154 I was able to buy it back at a $2.08 premium, netting a $0.82 profit for only a few hours hold.

Portfolio Standings

| Portfolio Value (Open) (Thurs) | $ 104,716.50 |

| Portfolio Value (Close) (Friday) | $ 104,905.50 |

| Change (R-F) | 0.18% |

| Change (Tot) | 4.91% |

| Free Cash (Close) | $ 80,785.50 |

| Escrowed Cash (Close) | $ 7,600.00 |

| Equities (Close) | $ 16,520.00 |

| Trades Made (R-F) | 3 |

Closing Thoughts

At the end of 8 weeks and heading into the holiday weekend here’s where I stand:

The Good

- Portfolio is up 4.91% vs a target of 4%.

- At this time over 80% of my portfolio is in free cash ready to make a trade

- I’ve been able to accomplish this with no leverage and only 5-10 min per day

The Bad

- Portfolio success is somewhat dependent on ENPH until I can dump it

- Probably missing out on bigger gains if I would take more risk

- Need to time better entry / exit points instead of relying on options to expire

Market is closed Monday for the Memorial Day holiday, short week next week!