7. Making Moves!

DISCLAIMER: This is a simulated educational exercise using paper trading fake money. This is not investment advice and is not intended to be copied.

TLDR

- Trades today

- SOLD -1 HUBS 100 14 APR 23 400 PUT @1.50

- BOUGHT 1 SNOW 100 14 APR 23 138 PUT @ 0.83

- SOLD -1 NFLX 100 21 APR 23 330 PUT @ 12.10

- Closed my SNOW position for a 40% profit in order to have enough funds for a NFLX trade

Today In Review

Today was an eventful day as well, but unlike yesterday a lot did happen. Let me break it down:

- I wrote a 2 days till expiry option for HUBS

- I noticed a bullish pattern for NFLX with a large premium, but didn’t have enough funds to cover the put

- I closed my SNOW position since it was the most risky, to release that capital so I could utilize against NFLX

- I wrote the NFLX put option

HUBS

This one admittedly may have been an impulse move. I was feeling antsy that I was below my weekly return rate and wanted to write an option. First thing in the morning I saw was the same patterns from the previous two days (stocks I didn’t really want to do anything with were the top trends). I then noticed HUBS flashing green:

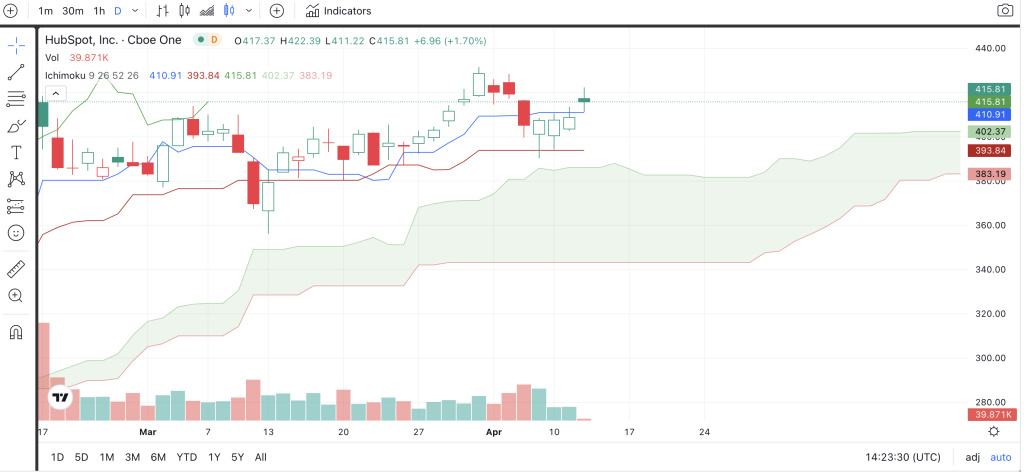

I looked into the technicals and saw a bullish trend on the Ichimoku Cloud:

However the RSI and Bollinger Bands weren’t necessarily screaming for upwards movement:

However given my mentioned itchy trigger finger, I decided to give it a go since there were only 2 1/2 days remaining until expiration anyway. I wrote a put option for a $400 strike. The resistance levels on the daily are a bit below that, so I am somewhat nervous I’m not getting enough premium for my risk.

NFLX (and SNOW)

As I was about to close out I was notified that NFLX was now showing green, and as I looked it up it sure was:

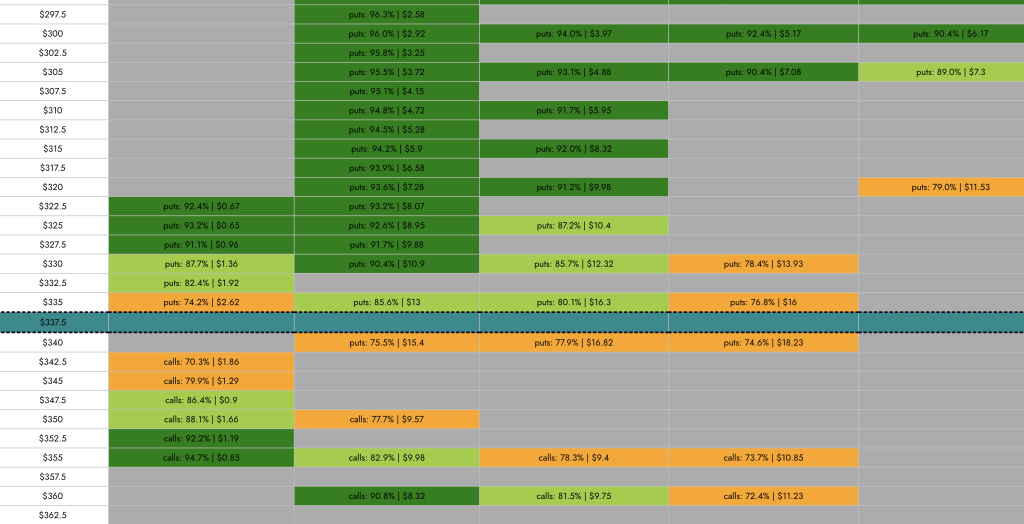

The AI was indicating a possibly strong level of support under the $330 range.

Given the fact that NFLX has earnings next week, I wanted to get in the game. Earnings weeks create volatility which drive up premiums. If you get the direction right, then there is a larger than normal premium you can collect for the same risk.

When I looked into next week I saw a 330 put with ~$12 of premium. I had to jump in and give that a try.

It’s worth noting I didn’t get time to screen shot, but the technicals weren’t giving the strongest bullish pattern here. So I very well can be put this stock. However given the premium and general positive trend of NFLX, I am willing to play the other leg of the option wheel with this.

As I had suspected would happen at some point this experiment, I was faces with an issue. I wanted to trade this option but didn’t have the ~$38k available to cover the put. Since I have a fixed portfolio, this means I either needed to wait for that capital to free up Friday and trade Monday, or close out an open position early to free up the funds on that trade.

I looked at my SNOW position which was set to expire Friday. It had been very volatile but was a net positive trade so far. I decided the opportunity for the NFLX option outweighed the ~$0.80 I would have to pay to buy back that option.

So I closed my SNOW position (~40% profit from open) and then wrote my NFLX contract.

Portfolio Standings

| Portfolio Value (Open) | $ 100,571.00 |

| Portfolio Value (Close) | $ 101,848.00 |

| Change (Day) | 1.27% |

| Change (Tot) | 1.85% |

| Buying Power (Close) | $ 9,000 |

| Trades Made Today | 3 |

Closing Thoughts

Such a busy day I didn’t even get the blog post out until the next morning! Need to pay close attention to this NFLX trade, let’s see what happens!