5. Welcome To Week #2

DISCLAIMER: This is a simulated educational exercise using paper trading fake money. This is not investment advice and is not intended to be copied.

TLDR

- Trades today

- SOLD -1 SNOW 100 (Weeklys) 14 APR 23 138 PUT @1.46

- Took a risky trade today on writing a put for SNOW. This is a calculated risk, as I’m okay being put the stock.

Today In Review

Today I spent about 10 minutes analyzing my AI and associated technicals, and boy did I have to think on my feet.

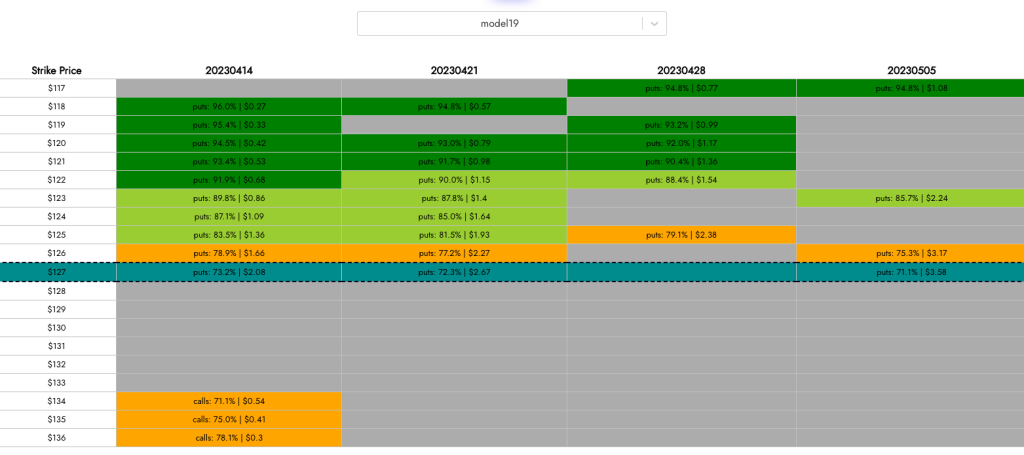

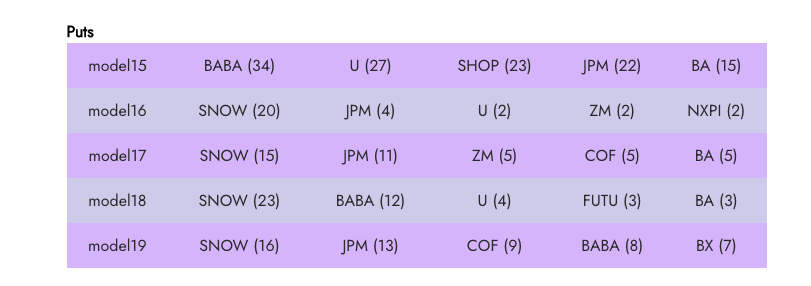

On first glance the AI was clearly showing a bias towards two stocks: JPM and SNOW.

First up JPM. The AI was indicating I should write a put, implying the price would be on the rise:

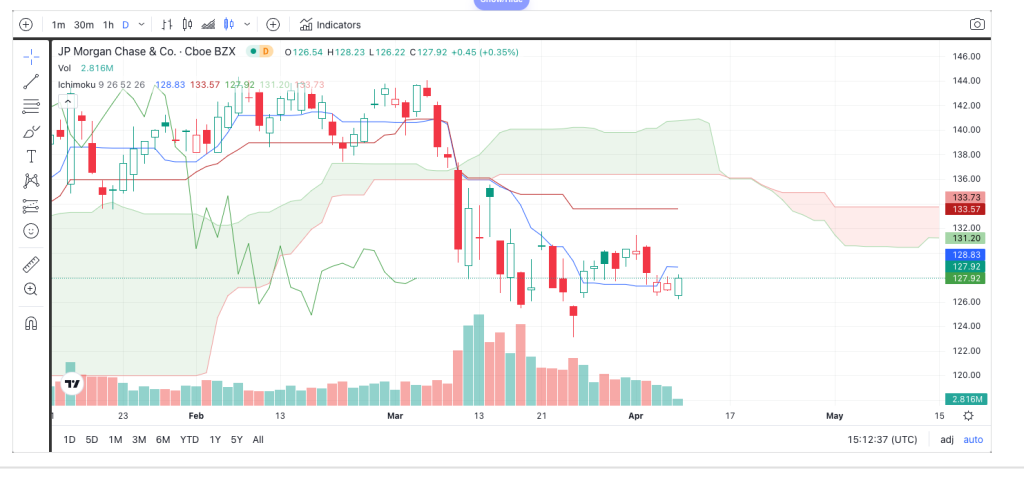

However when I looked at some basic technicals, I didn’t get the same feeling. Notably the Ichimoku cloud was very bearish on most periods, and volumes seemed to indicate a downtrend as well

The AI might very well be picking up on something, but given my unfamiliarity with JPM and the associated headwinds in that sector right now I didn’t want to use my capital on it.

Next I looked at SNOW. SNOW has been of particular interest to me recently so I was happy to see most models were aligning on it:

However when I looked at its technicals, it also didn’t give me a great feeling. It’s Ichimoku cloud, Bolinger Bands, RSI, and resistance levels all didn’t line up at the $138 put line I was hoping to write:

In other words, from my very amateur analysis I could see the price very easily dropping to the ~$134 range without breaking too many indicators.

Given that fact normally I would probably use caution and stay away from it. However there are two points at play here:

- In general I think SNOW has a chance for a break out given all the rise in AI and the demand for data.

- I’m using fake money

So I decided to YOLO into my put, and should I lose and be put the stock I will be willing to run the other half of the options wheel with this and write calls for sometime

Therefore, I traded the following option: SOLD -1 SNOW 100 (Weeklys) 14 APR 23 138 PUT @1.46

This locks up $13.8k of my funds in cover for the remainder of the week.

Portfolio Standings

| Portfolio Value (Open) | $ 100,425.00 |

| Portfolio Value (Close) | $ 100,571.00 |

| Change (Day) | 0.15% |

| Change (Tot) | 0.57% |

| Buying Power (Close) | $ 68,200 |

| Trades Made Today | 1 |

Closing Thoughts

Interested to see what happens with my SNOW put. The price went up today so I may squeak by, but kinda eager to get my hands dirty with some call side trading as well. Let’s see what happens this week and whether or not I made a major mistake!